The COVID-19 Health Recovery Levy was introduced in 2021 under the COVID-19 Health Recovery Levy Act (Act 1068) as part of measures to rebuild public health systems and shore up state finances during the pandemic.

Signed into law on March 31, 2021, it imposed a 1% levy on the value of taxable goods and services, as well as most imports—charged in addition to VAT, NHIL, and the GETFund levy.

Repeal Takes Effect January 2026

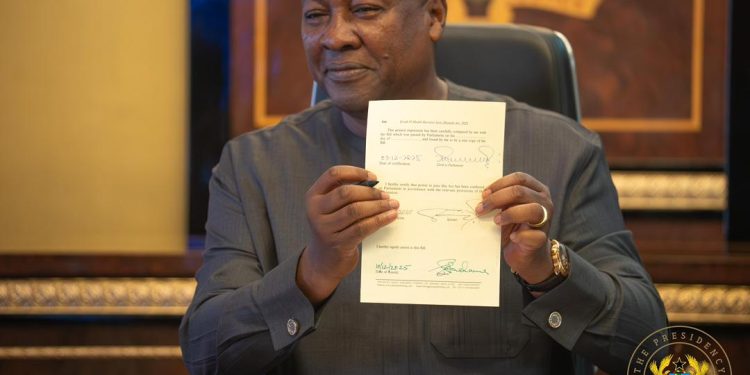

Following Parliament’s approval in November 2025, President Mahama on Wednesday gave his assent to the repeal, which will take effect from January 2026.

This means consumers and businesses will no longer pay the extra 1% charge at the point of purchase or importation.

Government’s Rationale

Government officials say scrapping the levy forms part of a broader fiscal reform agenda aimed at:

reducing the cost of living,

easing the tax burden on small and medium-scale enterprises, and

enhancing economic competitiveness.

The repeal is also expected to bring some relief to import-dependent businesses already battling exchange-rate pressures and rising operational costs.

https://youtu.be/1t5InHaPFVc